Crypto’s Boldest Bull Market Calls: Predictions and Insights You Need to Know

Wild Predictions, Risky Moves & AI Future — The Boldest Takes in Crypto Right Now

gm friends,

Welcome to this week’s edition of "Alpha Tweets," where we’ve gathered some of the most provocative and controversial takes in crypto. This week, we’re diving into big predictions for a potential bull run, discussions on altcoin strategies, and insights into the future role of AI in crypto. Let’s break it down!

--

-

Tweet 1: Crypto Bull Market Incoming?

HighCoinviction believes a massive bull market is on the horizon, especially if Trump wins the U.S. presidency. He explains why this could lead to a “supercycle” for crypto assets.

- Pro-Crypto Regulatory Environment

Trump’s win could mean relaxed crypto regulations. For example, the SEC chair might be replaced, and the U.S. could treat crypto more like a "sandbox" for innovation. This could make the U.S. a major player in crypto, even potentially holding Bitcoin as a strategic reserve asset (like gold for the digital age).

- Retail Interest Revival

Retail investors (everyday people) are currently hesitant, but a favorable regulatory shift could reignite their interest in crypto. HighCoinviction suggests that BTC hitting new highs is just the beginning.

- Price Predictions

- Bitcoin: Could reach $250K in this cycle.

- Solana: Might hit $1,000 if a Solana ETF launches in 2025.

🔗 [Visit Tweet](https://x.com/HighCoinviction/status/1854043885871514111)

---

Tweet 2: Second-Order Effects of a Trump Win on Crypto

Alpha_pls outlines how a Trump presidency could indirectly boost crypto adoption in the U.S. Here’s why:

- Bitcoin as a National Reserve Asset

Imagine the U.S. holding Bitcoin like a national asset (similar to gold reserves). This could change how BTC is perceived globally, adding credibility and stability.

- Looser Token Regulations

- Currently, many tokens are classified as "securities," which means strict regulations.

- Under Trump, most tokens could be reclassified as "commodities," simplifying regulatory requirements and making it easier for crypto projects to grow.

- Increased Bank Involvement

Banks may start offering more crypto services, including stablecoins issued by banks themselves (like a “Bank USD Coin”). This could make crypto more accessible for everyday people.

🔗 [Visit Tweet](https://x.com/alpha_pls/status/1854078376966815858)

---

Tweet 3: Altcoin Breakout on the Horizon?

Pentoshi sees a potential altcoin breakout, with altcoins reaching a $760 billion market value.

- Targeting $760 Billion

Pentoshi believes altcoin value could surge back to this mark, representing a significant recovery.

- Choosing the Right Altcoins

- Instead of following “lagging” altcoins (those struggling to catch up), he suggests focusing on coins with strong market momentum.

- Example: If a coin has been trending upward while others remain flat, it may have a better chance of breaking out.

🔗 [Visit Tweet](https://x.com/Pentosh1/status/1854183833245188228)

---

Tweet 4: ETH vs. SOL Sentiment: Which Will Flip?

DefiIgnas has a contrarian take on the ETH vs. SOL rivalry.

- “Flippening” Narrative

He suggests that if people get overly excited about SOL potentially surpassing ETH (a “flippening”), it might actually be a good signal to buy more ETH instead.

- Example: When SOL vs. ETH hype is high, some investors might overestimate SOL’s strength, giving ETH holders a better entry point.

🔗 [Visit Tweet](https://x.com/DefiIgnas/status/1854042261304103174)

---

Tweet 5: Bull Market Strategy: Focus and Simplify

ColdBloodShill emphasizes that during a bull market, it’s better to focus on a few areas rather than spreading yourself thin.

- Less is More

- Instead of trying to invest in every trending coin, choose a specific area—such as DeFi or crypto stocks—and become an expert in it.

- Focusing allows you to understand the market better and make more strategic moves.

- Benefits of Focus

- Example: Rather than managing 15 different coins, sticking with 3-4 projects lets you track each one closely, understand its cycles, and avoid impulsive decisions.

🔗 [Visit Tweet](https://x.com/ColdBloodShill/status/1854517740008083794)

---

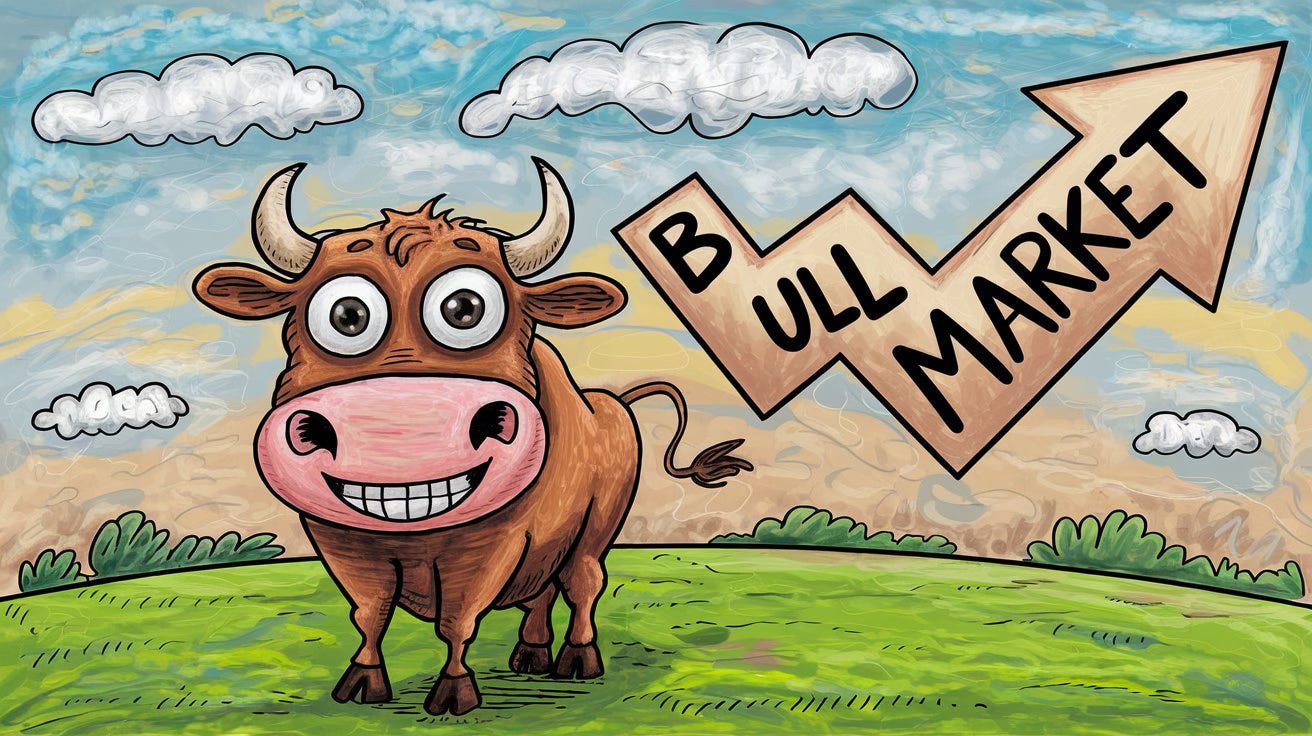

Tweet 6: Retail FOMO and the “Gambling Supercycle”

OSF points out that retail (individual) investors are getting back into crypto in a big way—but with a twist:

- High-Risk Appetite

- Unlike past bull runs where people focused on BTC and ETH, this time retail investors are asking for “low cap” coins with high-risk, high-reward potential.

- OSF calls this the “Gambling Supercycle” and suggests it could lead to risky behavior.

- Example: If a friend who’s new to crypto asks you for “lottery ticket” coins instead of BTC or ETH, it might be a sign of increased market speculation.

🔗 [Visit Tweet](https://x.com/osf_rekt/status/1854314572892508338)

---

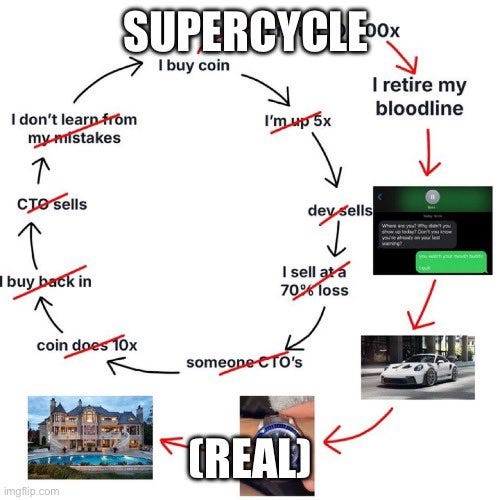

Tweet 7: Key Insights on Airdrop Strategies

Keyrock shares recent research on airdrops, with useful insights for anyone looking to make the most of them.

- Success Rate

- Only about 11% of airdrops succeed, while most crash within two weeks. This suggests that airdrops are risky, and picking the right ones matters.

- Distribution Tips

- Example: Projects that distribute over 10% of their tokens see better price action than those giving out less than 5%, which often leads to quick sell-offs.

- High FDVs (fully diluted valuations) and low liquidity are usually red flags.

- Examples

- Successful: $JUP

- Crash within 15 days: $OMNI

🔗 [Visit Tweet](https://x.com/flb_xyz/status/1854239738850656331)

---

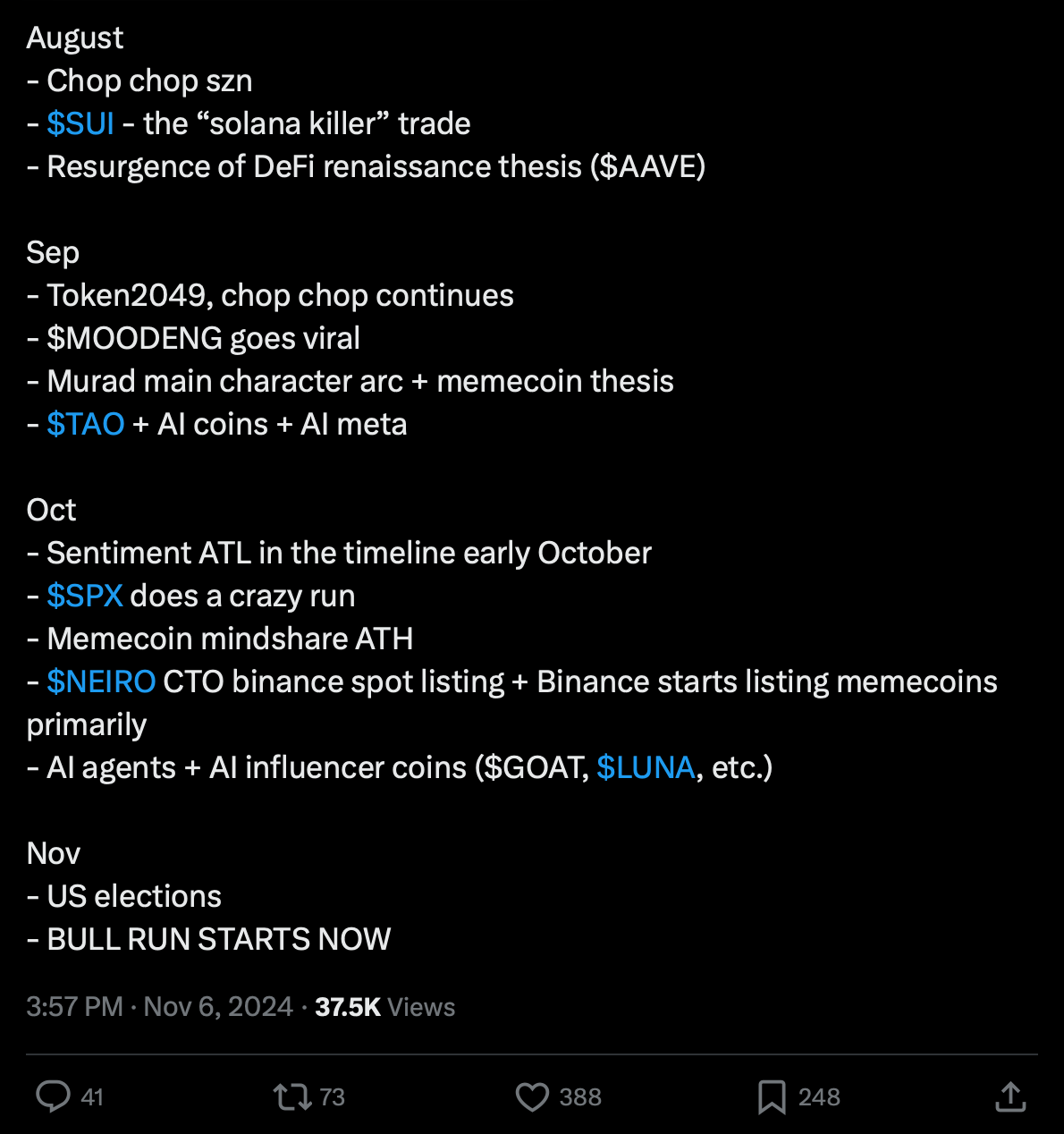

Tweet 8: 2024 Crypto Narratives Speedrun (Jan - Nov)

Sandraaleow provides a month-by-month recap of the major themes and narratives that have dominated crypto so far in 2024:

- Sample Trends

- January: Layer 2 (L2) scaling solutions and ETH-related narratives.

- February: SocialFi platforms like Friendtech take off.

- March: The rise of “presale meta” projects.

- Changing Narratives

- Each month has seen different trends gain popularity, reflecting crypto’s fast-paced and ever-evolving market.

- Example: A project that was popular in March (like a presale) might lose traction by June when a new trend takes over, such as AI coins.

🔗 [Visit Tweet](https://x.com/sandraaleow/status/1854108440572170691)

---

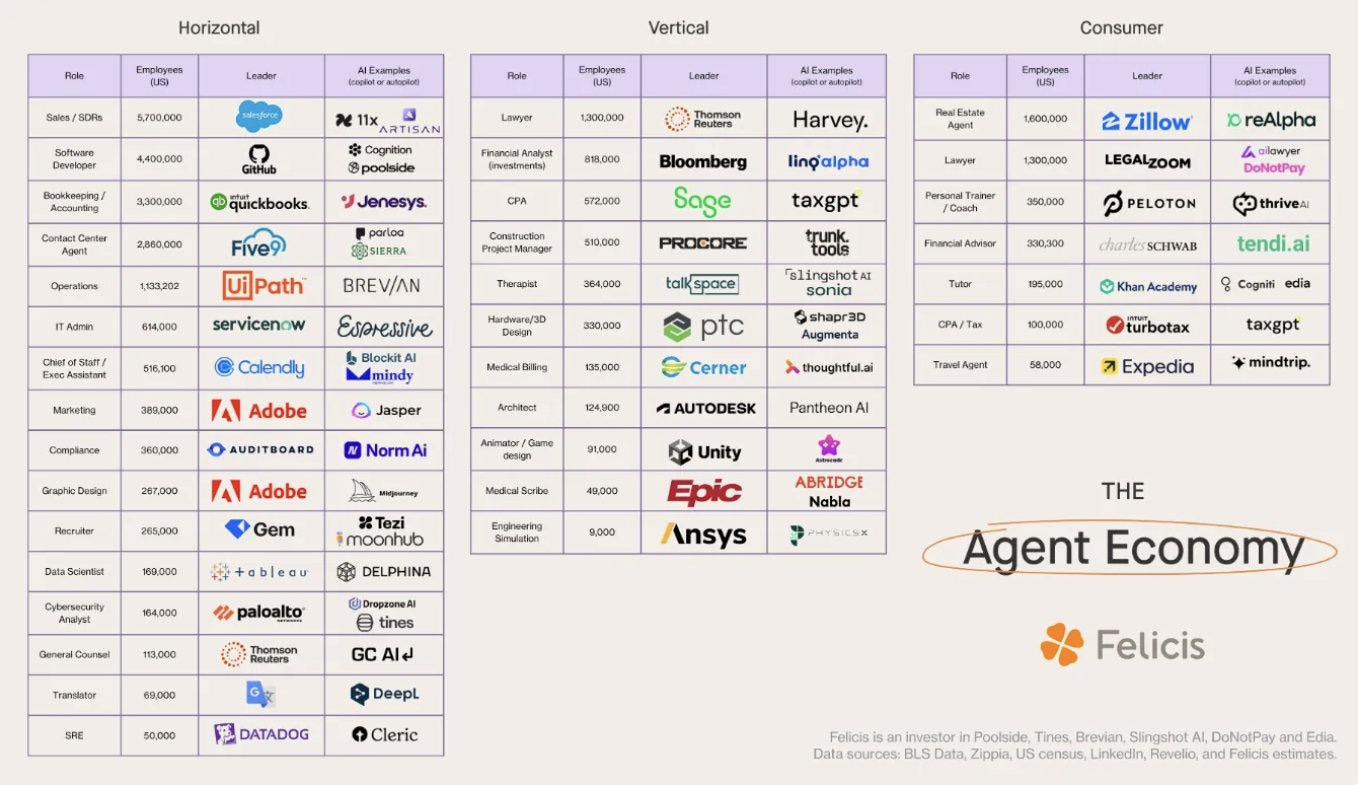

Tweet 9: The Dawn of the Crypto Agentic Era: AI and Crypto’s Intersection

Teng Yan (@0xPrismatic) explains why he believes AI could drive crypto adoption into the mainstream.

- AI Agents & Crypto Synergy

- As AI agents (programs that act without human intervention) grow in popularity, crypto infrastructure is ideal for their transactions and communication.

- Example: AI agents could use crypto wallets for secure and instant payments.

- Multi-Agent Future

- Instead of one big AI controlling everything, we’re likely to see specialized agents each focused on a specific task (e.g., payments, data analysis), working together in a decentralized network.

- From Demos to Reality

- While AI agents are still in the demo stage, he believes improvements in accuracy and functionality could make them mainstream soon, especially with crypto as their foundation.

🔗 [Visit Tweet](https://x.com/0xprismatic/article/1854513654156398961)

---

And that’s your alpha!

Thank you for reading. This week’s tweets are a snapshot of the bold ideas shaping crypto’s future—from potential supercycles to AI agents running decentralized economies. Stay tuned for more insights to keep you on the cutting edge. See you next time!